What’s Your Home Worth Now? Not What You Think

When was the last time you checked your home's value? For most Jacksonville homeowners, it's probably been a while. But how much is it really?

Not what you paid for it. Not what Zillow guessed last year. I mean what a real buyer would hand you for it today, in this market.

I meet homeowners every week who are genuinely shocked when I show them their property's current market value.

Your Home’s Been Working Overtime

We don’t always think of our homes as part of our wealth. But if you’ve been living in your house for a few years (or even just a couple), it’s probably been building equity in the background like a quiet little savings account you forgot you had.

And in Jacksonville? That savings account may have grown a lot faster than you think.

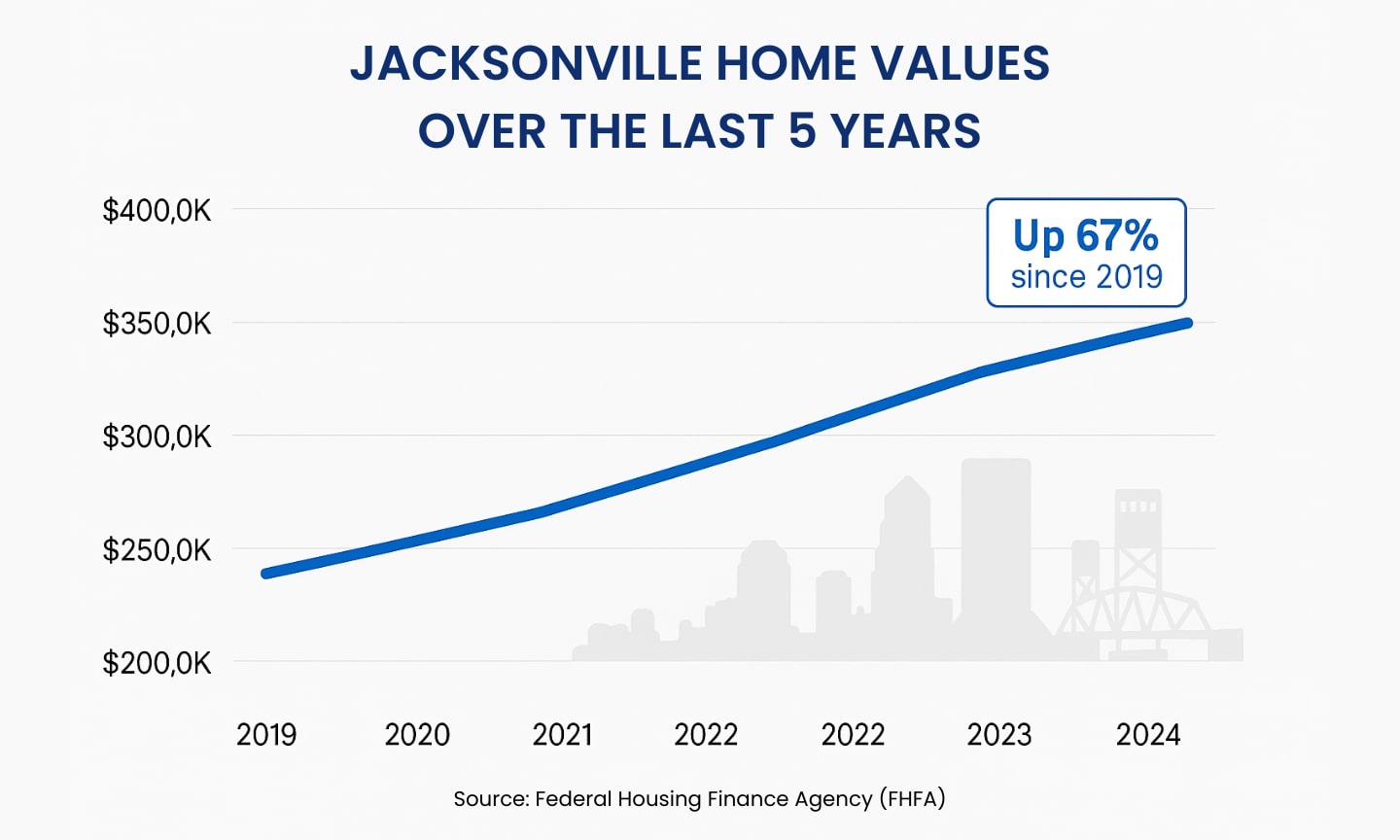

Take a look at what’s happened here over the last 5 years. Home prices in Duval County have surged—some estimates show values have gone up over 60% since 2019. That’s not a typo. And with the way our market’s been holding steady despite higher interest rates, we’re still seeing strong demand across a lot of neighborhoods.

What’s Home Equity, and Why Should You Care?

Quick breakdown: home equity is the difference between what your house is worth and what you still owe on your mortgage.

Let’s say your Jacksonville home is now worth $400,000, and you owe $220,000 on your mortgage, you're sitting on $180,000 in equity.

That’s real money. Not Monopoly money. That’s wealth you can tap into now.

And according to a recent report from Cotality (formerly CoreLogic), the average homeowner with a mortgage is sitting on over $300,000 in equity across the U.S.

Here in Jacksonville, many are right in line—or even above that—especially in hot neighborhoods like San Marco, Mandarin, and the Southside.

Why You Might Have More Than You Think

Factors working in your favor right now:

- Strong Migration to Northeast Florida

The pandemic accelerated what was already happening – people fleeing higher-cost states for our sunshine, beaches, and lower cost of living. According to Florida's Office of Economic and Demographic Research, Duval County alone has welcomed over 30,000 new residents in the past three years.

More people = more demand = higher home values.

- People are staying longer.

Gone are the days of moving every 3 to 5 years. Now, folks are living in their homes for closer to 10 years, and during that time they’re paying down their loan and watching their property grow in value.

So What Can You Actually Do With That Equity?

This is where it gets exciting. That equity could open the door to a lot of possibilities—some you may not have even considered:

- Upgrade to a bigger or better-located home. Want a backyard pool or to get into a different school district? Your current home’s equity might be your ticket.

- Downsize and cash out. Maybe it’s time to simplify and pocket the difference.

- Renovate and enjoy it now. Been putting off that kitchen remodel or outdoor living space? Your equity could fund it—and raise your value even more.

- Pay off debt or invest. Think bigger: paying down high-interest loans, starting a business, or even helping your kids with college.

The point is, you’ve got options. You just need to know what you’re working with.

So… What’s Your Home Really Worth?

You won’t get the full picture from a generic online estimate. Those tools can’t see the upgrades you’ve made, the street your house sits on, or how demand is trending in your exact ZIP code. But I can.

As a local agent who works day in and day out in Jacksonville, I can give you a real, detailed, no-strings-attached look at your home’s current value and what it could mean for your future. Because this isn’t just about a number. It’s about strategy. Timing. Life changes.

And your next chapter might be closer than you think.

Ready to See What You’re Sitting On?

Reach out anytime for a free, local market evaluation tailored to your home and your goals. I’ll bring the coffee or the iced tea, because hey, this is Jacksonville.

And who knows? You might be one decision away from something really big.

Categories

Recent Posts

GET MORE INFORMATION