How to Afford a House Despite Higher Interest Rates

If you're house hunting in Jacksonville right now, you've probably heard the same advice from friends and family: "Wait until mortgage rates drop!" It's well-intentioned guidance, but what if your timeline doesn't allow for waiting? Perhaps you've outgrown your rental, landed a new job in a different neighborhood, or found your dream home in Riverside or San Marco that won't stay on the market long.

The truth is, waiting for significantly lower rates might leave you on the sidelines longer than expected. As a Jacksonville real estate agent who frequently works with buyers and investors, I've seen many families successfully purchase homes despite today's interest rate environment. Here's how you can too.

The Rate Reality Check

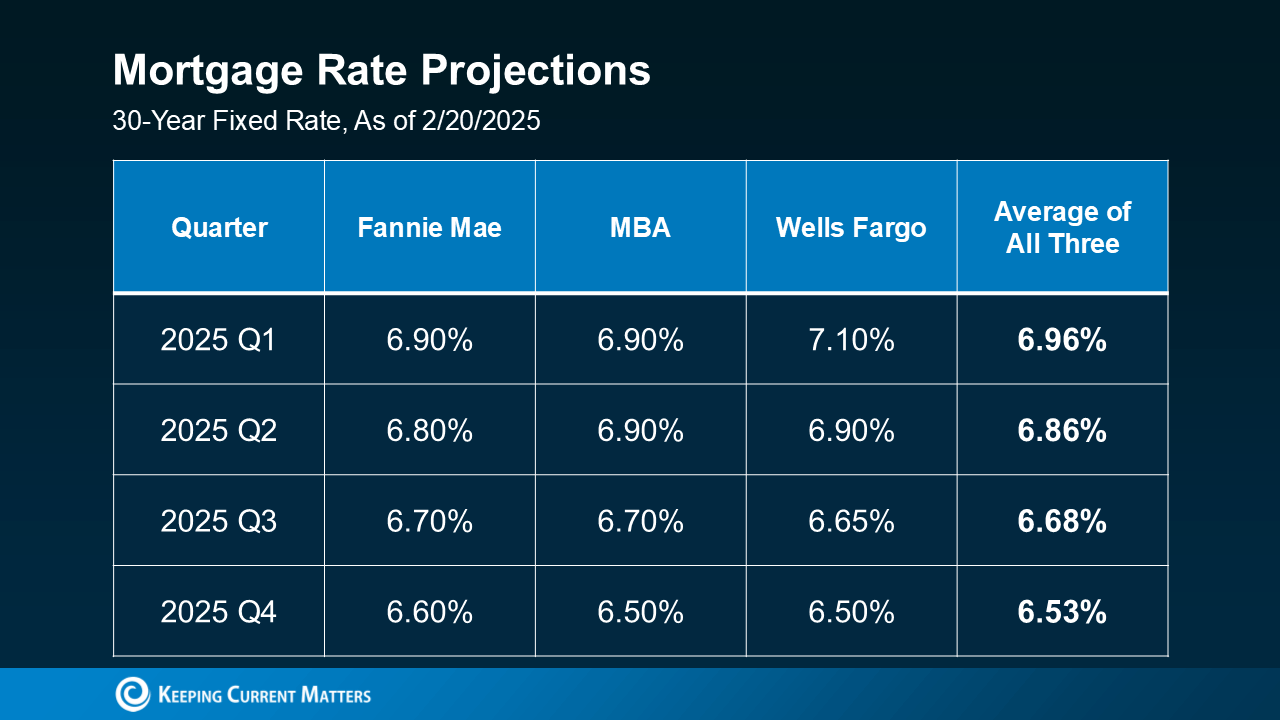

Recent forecasts from major institutions like Fannie Mae, the Mortgage Bankers Association, and Wells Fargo suggest mortgage rates will likely stabilize around 6.5% by year's end—not the dramatic drop many hopeful buyers are waiting for.

Here in Jacksonville, where our market remains competitive due to continued population growth and limited inventory, waiting for lower rates comes with a real cost. Home prices in desirable neighborhoods like Mandarin, Atlantic Beach, and Julington Creek continue to appreciate, potentially offsetting any future savings from rate decreases.

Smart Financing Options for Jacksonville Buyers

Instead of putting your life on hold, consider these practical financing strategies that my clients are using successfully right now:

1. Seller-Assisted Buydowns

Many sellers are willing to negotiate on terms beyond just price. With this option, your interest rate is reduced by 2% in year one and 1% in year two before settling at the standard rate for the remainder of the loan.

The mechanics are straightforward: if market rates are 7.5%, you'd pay just 5.5% interest in year one and 6.5% in year two. This creates a meaningful payment reduction during those crucial early years of homeownership when expenses often feel most overwhelming.

I've noticed sellers in Julington Creek and Nocatee are particularly open to these arrangements as homes sit slightly longer on market compared to last year. One savvy client actually negotiated a price reduction plus a buydown by highlighting the longer days-on-market to the seller.

2. Strategic ARM Selection

Adjustable-rate mortgages have evolved significantly since the housing crash. Today's ARMs come with built-in protections and can be particularly smart in Jacksonville's current market.

The 7/1 and 10/1 ARMs are proving popular with my clients who are either planning to refinance within a few years or expecting salary growth.

What makes ARMs especially attractive in Jacksonville is our city's strong job growth trajectory, particularly in healthcare, financial services, and logistics. Many ARM borrowers are professionals expecting income growth that will offset any potential rate increases when the adjustment period arrives.

The key with ARMs is understanding the caps—how much your rate can increase at each adjustment and over the life of the loan. Most of today's ARMs limit annual increases to 1-2% with lifetime caps around 5%. Your lender can run scenarios showing worst-case adjustments so you can make an informed decision.

3. Assumable VA Loans

With our strong military presence thanks to NAS Jacksonville and Mayport, our market has numerous homes with assumable VA loans. If you're eligible, taking over a seller's existing 3-4% VA loan can be a game-changer in today's environment.

The process requires working with both the VA and the current loan servicer, but the savings justify the extra paperwork. VA assumption candidates should start by getting their Certificate of Eligibility ready and connecting with a lender experienced in these transactions.

I've seen successful assumable loan transfers in Atlantic Beach, Mayport, and Orange Park communities where military families frequently sell. The key is finding these opportunities quickly, as they typically generate multiple offers when priced appropriately.

4. First-Time Buyer Programs

Jacksonville also offers several assistance programs specifically designed for first-time buyers. The Jacksonville Housing Authority and Northeast Florida Housing Partnership provide down payment assistance that can free up funds for buying points to lower your interest rate.

These programs often have income limitations, but they're more generous than many assume. A family of four can earn up to $95,900 and still qualify for some assistance programs in Duval County. Combining these programs with lender credits can significantly reduce your upfront costs.

Jacksonville's H.O.M.E. program provides up to $50,000 in down payment and closing cost assistance in targeted revitalization areas. This can be paired with lower-than-market interest rates through participating lenders.

Springfield, Murray Hill, and parts of the Northside offer both affordable entry points and eligibility for these programs, making them smart targets for first-time buyers in today's market.

Taking Action Now

Thankfully, I’m partnered with lenders that will help you explore your options. Rather than waiting for perfect conditions that may not materialize, connect with me today! let’s discuss your situation and the solutions that might work for you.

Every situation is different—your job stability, down payment funds, and long-term plans all factor into the decision. But remember: people successfully bought homes when rates were 8% in the 1990s and even 18% in the 1980s.

Categories

Recent Posts

GET MORE INFORMATION