Jacksonville Housing Market 2025: Why Buying Now Beats Waiting for Perfect Timing

I often hear the same question from buyers: "Should I buy now or wait for prices to drop?" It's a valid concern, especially with recent interest rate shifts and changing home prices in our area. But here's what 15 years of selling homes in Jacksonville has taught me - waiting for the "perfect moment" to buy often means missing out on years of potential gains.

Right now, homes in popular Jacksonville neighborhoods like Mandarin and San Marco are showing steady appreciation, even as the market adjusts to higher interest rates. A $350,000 home purchased in Riverside just five years ago is worth roughly $475,000 today. That's the power of time in the market.

Consider this: Jacksonville's population grew by 3.4% last year, driving consistent demand for housing. Our city's strong job market, with major employers like Mayo Clinic and CSX Corporation expanding their presence, continues to attract new residents. This steady population growth, combined with limited housing inventory, creates a foundation for long-term home value appreciation.

But what about rising interest rates? Yes, rates are higher than they were in 2021, but they're still below historical averages from the 1980s and 1990s. More importantly, you can refinance your loan when rates drop, but you can't go back in time to capture missed equity gains.

Let's look at a real example from our market. A client of ours debated buying in Jacksonville Beach throughout 2022, hoping prices would fall. They finally purchased their home in late 2023 for $450,000. In that waiting period, they missed out on approximately $25,000 in appreciation and paid a higher interest rate. Meanwhile, their rent increased twice.

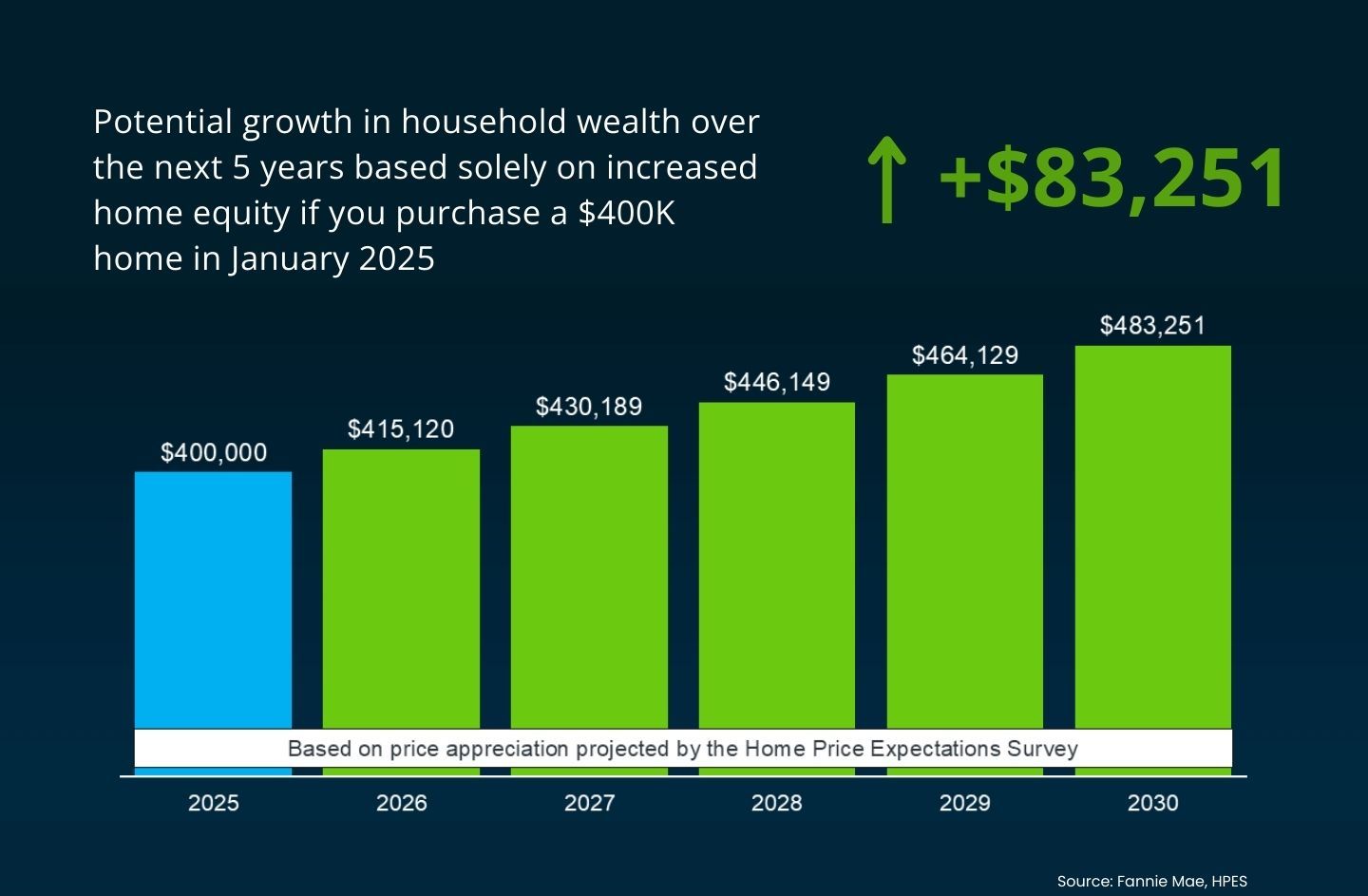

The math is clear: If you buy a $400,000 home in Jacksonville today, based on conservative market projections, you could build over $80,000 in equity by 2030. That's wealth you're building while simply living in your home. Renters in our market are paying an average of $1,800 monthly, with nothing to show for it long-term.

What about affordability? Jacksonville offers numerous paths to homeownership. First-time buyers might consider starting with a townhouse in Wolf Creek or condos in Jacksonville Beach. Many first-time buyers don't realize there are numerous down payment assistance programs available to help with initial costs. For example, the Jacksonville Housing Authority offers up to $50,000 in down payment assistance for qualified buyers.

Here's what matters: every month you wait is a month of lost equity building. While timing the market perfectly might seem tempting, history shows that the Jacksonville market rewards long-term homeowners. Our city's strong economic fundamentals, growing population, and relative affordability compared to other Florida metros suggest continued steady appreciation.

The best time to buy a home isn't when the market is perfect - it's when you're financially ready and find a home that meets your needs. Interest rates will fluctuate, home prices will rise and fall, but the long-term trend in Jacksonville real estate has consistently pointed upward.

Are you ready to explore your options in Jacksonville's market? Contact me now to discuss your homebuying goals and create a strategy that works for your situation.

Categories

Recent Posts

GET MORE INFORMATION